Housing affordability on the way up

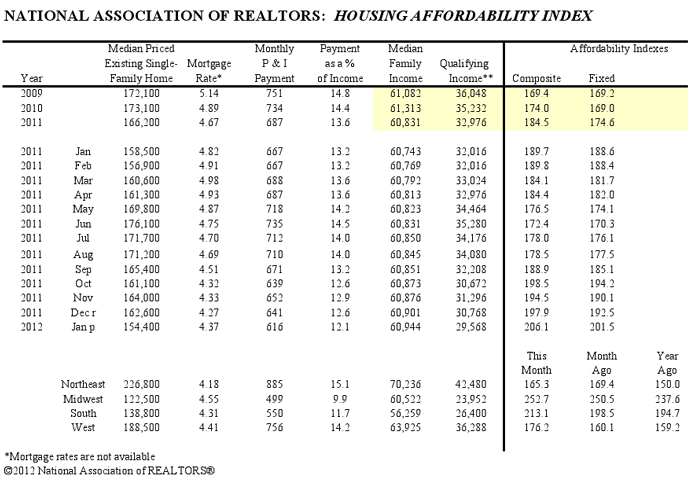

Despite a dismal economy and a shifting buyer pool, housing affordability conditions have reached the highest level since recordkeeping began in 1970, according to the National Association of Realtors’ (NAR) Housing Affordability Index (HAI).

NAR determines affordability by measuring the relationship between median home price, median family income, and average mortgage interest rates. When the HAI is high, the purchasing power of a household is high as well. NAR notes, “An index of 100 is defined as the point where a median-income household has exactly enough income to qualify for the purchase of a median-priced existing single-family home, assuming a 20 percent downpayment and 25 percent of gross income devoted to mortgage principal and interest payments.”

The caveat: first time buyers

While affordability for most is high, NAR notes that first time buyers making small down payments are not enjoying affordability levels of that of repeat buyers.

NAR President Moe Veissi, broker-owner of Veissi & Associates Inc., in Miami, said this latest data underscores buyer opportunities in today’s market. “This is the first time the housing affordability index has broken the two hundred mark, meaning the typical family has roughly double the income needed to purchase a median-priced home,” he said. “For buyers who can qualify for a mortgage, now is a very good time to become a homeowner.”

Projections of continued improvement

NAR projects the affordability index for all of 2012 will be at an annual high, with little movement in mortgage interest rates or home prices during the year.

“Housing inventory levels have declined to a point where conditions are becoming much more balanced in much of the country,” Veissi said. “If access to credit improves, we could see a much more meaningful increase in home sales and broader stabilization in home prices with modest gains in areas with stronger job growth.”

Not so fast

While the largest trade association in America is optimistic, albeit cautiously so in recent tradition, AGBeat columnist, Jeff Brown notes that a real estate recovery is not imminent, pointing to the four million to six million homes entering, leaving, and inside the foreclosure pipeline.

Brown notes that those millions of homes aren’t going away. “When the pipeline is cleared, the clog removed, we’ll be back to looking forward to a recovered real estate market. It should be an interesting look back in around 3-9 months. The mistake that might be in play here, is that the fundamentals haven’t changed. Sure, reduced inventory is a fundamental. But, if said inventory was reduced as a consequence of a short lived ‘hairball,’ then the fundamental never really changed, did it? Not from where I sit.”

Rentennials don’t plan to buy

Additionally, a real estate recovery hinges upon buyers coming back to the market, but with an entire generation (the next generation of buyers) opting to rent and shedding the stigma of renting, the “Rentennials” are purposely choosing not to buy.

Good.is columnist, Mark Bergen recently wrote a critical piece on the topic, noting that as a Millenial, he’s not unique in that he rents. “I’m not alone: in unprecedented droves, our generation is opting to rent. We’re doing it in major cities, where renting has always been plentiful, and in smaller ones, where it hasn’t. A stream of recent articles has arrived wondering why Millennials aren’t buying homes. The stories paint us as victims of rising rents, saddled with student debt and a crappy economy that keeps the American dream out of our reach.”

Bergen continues, “But what if renting wasn’t our curse? What if, instead, we celebrated and embraced it? By many counts, renting is a financially savvy move. It can free us up for careers and lives in ways that ownership cannot. And the more of us who rent, the more opportunity we have to alter a system that is stacked horrendously against renters.”

The takeaway

Affordability is on the rise, as are other housing indicators that spell for a healthier market, but with millions of homes clogging the foreclosure pipeline and an entire generation choosing to rent, a recovery is not as black and white as we all may have hoped, and we haven’t seen this movie before, so instead of repeating a past economic cycle, buyer behavior might dictate a different end to this movie.

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.

John Slocum

March 7, 2012 at 11:42 pm

With Consumer Confidence finally starting to show better readings, our market is starting to see a surge of pending home sales — much better than this time last year. I wouldn’t count out the Millenials as a material part of the home ownership equation just yet.