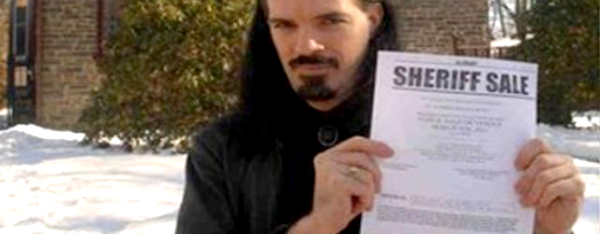

Right now in Philadelphia, there are black and white Sheriff’s Sale posters all around town after a two year battle between Wells Fargo and a single long haired goth homeowner comes to a head.

Right now in Philadelphia, there are black and white Sheriff’s Sale posters all around town after a two year battle between Wells Fargo and a single long haired goth homeowner comes to a head.

Patrick, a single homeowner with a century old 6 bedroom 3 bath Tudor home bought for $180,000 in 2002 has paid his mortgage on time for seven years. A few years ago, he opens his mail to find a notice that his premiums are doubling, requiring a $1,000,000 insurance policy in the event the home is destroyed and needed to be rebuilt. Patrick cannot afford such an increase in his monthly budget.

Loan holder Wells Fargo also added extra “inexplicable fees” to his account. One of the mystery fee line items was two home inspections in a single month despite zero inspections occurring. He was offered no explanation. Two years ago, Wells Fargo stopped responding to his letters requesting more information.

Patrick did what most people do in modern times- he hopped online. He learned about RESPA which allows a Qualified Written Request (QWR), a letter that a loan holder can send to their mortgage servicer who is legally obligated to acknowledge within 20 days and take action within 60.

If no response or action is taken, loan holders can sue for actual damages, costs and attorney fees, plus $1,000 in additional damages if there is a pattern of noncompliance.

Wells Fargo did not respond to the QWR, so Patrick filed a claim in small claims court where he represented himself after no lawyer would take his case and Wells Fargo sent no representation, thus a default judgment for $1173 was granted (which he eventually recovered). But still, no response to his letters or change to his premiums, both of which were legally required.

Patrick didn’t quit. He filed for a Sheriff’s levy on the local Wells Fargo branch that had ignored him over these past years. By paying a simple $50 deposit for administrative costs, showing the county clerk his default judgment, he got the Writ of Execution, Instructions for Levy, and a handful of Sheriff’s Sale posters to put up around town.

Patrick happily hung the posters around town and sent copies to the media.

This brings us to today:

Last week, the court put a temporary hold on the sale and ordered a hearing for February 23. Meanwhile, a “high ranking” Wells Fargo executive has agreed to meet with Patrick but we have not yet heard if he has taken the meeting.

The industrial music promoter slash goth enthusiast is being called a folk hero for fighting the Wells Fargo/big bank machine.

Last fall, Austinite Jaime Furtado went on a hunger strike for the very same reason– Wells Fargo ignored him and his requests for an explanation and for help sorting out his account.

Wells Fargo has had many fingers pointed their way for various abuses but the common factor is an inability and what seems to be an unwillingness to address the little people- those pesky loan holders (the ones who pay their salaries). Something is seriously wrong with this picture… this feels like when an entire city knows that an intersection is dangerous but city council is waiting for someone to die before they take action.

Do YOU have a local story along these lines that you believe deserves attention? Email the editor.

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.

jlittleaz

February 21, 2011 at 10:23 am

I hope you will be able to keep us informed as this progresses.

Ken Montville

February 21, 2011 at 12:56 pm

Alright!! Some David finally took on the Goliath and is winning. It just goes to show how clueless the “big banks” are about the needs of their customers and the obvious internal inefficiencies of their own business. Go, Patrick!

Chris Lengquist

February 21, 2011 at 2:16 pm

I beg all my clients and readers to move their money, all their money, out of Wells Fargo and Bank of America and put it in small community banks. Small beans on one account. But if everyone would quit using them they’d be in real trouble. 🙂

John

February 21, 2011 at 4:05 pm

Cheers to this guy.

I recently cleared all my accounts with Wells Fargo. At one time I had checking, savings, mortgage, and business lines with them and the more I did business the more I grew to hate them. The day they, without notice, decided to pull every last penny out of my checking to pay off part of the business line is the day I decided to never do business with them again. I was left with nothing to pay the mortgage or feed my children. I don’t accept checks from them anymore nor do I wire (even from other banks) because they take a cut on every wire ever made from anywhere. They’re scumbags after one thing and that’s to suck you dry and move on to next victim.

Susan Milner

February 21, 2011 at 5:42 pm

Love this! The banks need to take responsibility and get their acts together.

MH for Movoto

February 22, 2011 at 7:29 pm

God bless the goth kids. I hadn’t heard this story, so thanks for sharing – it thoroughly brightened my afternoon.