Rising mortgage delinquencies

As the White House seeks methods do save distressed homeowners, a growing number of economists are advocating for the opposite, pushing for acceleration of “the inevitable” to expedite the bottoming out of the housing sector so a natural recovery can begin, according to CNN Money.

“Loans enter into foreclosure, but never come out,” Thomas Lawler, founder of Lawler Economic & Housing Consulting told CNN. “If this keeps going on, you have a continual overhang that never goes away.”

Shadow inventories

Some claim shadow inventories are a myth while others call it the plague of housing that threatens a slow recovery.

“They can’t be a glacier hanging over the market with everyone waiting for it to fall,” Jim Gaines, research economist at The Real Estate Center at Texas A&M University said to Fortune Magazine. “Those properties have to clear the market.”

What is the answer?

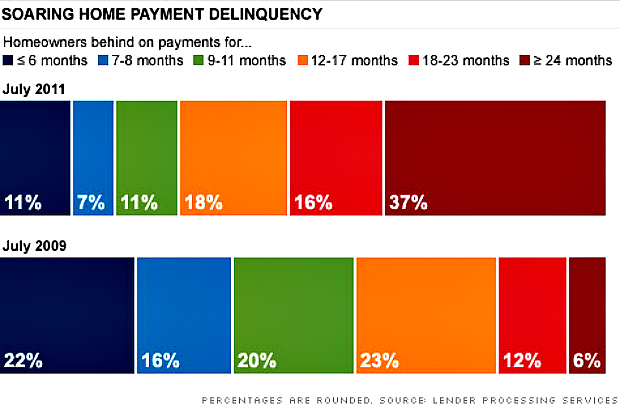

It is clear that the current regulated path isn’t working, just look at the difference over two years in the chart above. Could acceleration be the answer? What of the hundreds of illegal foreclosures happening every year and the homeowners who never anticipated being so far underwater? Could aiding homeowners help or would that slow down the inevitable bottoming out of the market so desperately needed before we recover? No one agrees on the way forward, but the graph above better change- quickly.

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.

Brandon

September 1, 2011 at 9:35 am

This is a tough question, but it makes me think of that old saying about the definition of insanity is doing the same thing and expecting different results. There is a really nice home in my neighborhood — a foreclosure abandon — that's been empty for about 2 years now. Something's got to give, right?

Liz Benitez

September 2, 2011 at 1:38 pm

I'm not an economist. I really don't know what is the best move but you are right. We keep trying the same thing over and over again for several years now. We need to start doing something different. We need to start moving forward.

Mark

September 4, 2011 at 10:31 pm

Principal Reduction Program and Financial Planners

“The key to solving the underwater mortgage crisis”

There are some proactive ideas floating around in the Financial Sector that show promise in helping to solve the Underwater Mortgage crisis. One idea being implemented by Ocwen Financial Corporation has to do with Mortgage Principal Reduction. Ocwen is one of the largest servicers of distressed home mortgages in the country, began offering more than 3,000 underwater borrowers Mortgage Principal Reduction in a test that began a year ago.

The Principal Reduction test program works like this:

Program restores some equity in the borrowers' property, which helps motivate them to stay current on their modified loan payments and avoid foreclosure.

Modify underwater borrowers' loans so that their payments are reduced to a manageable amount and cut their principal debt over time

Make the deal dependent on their scrupulous on-time monthly payments of the new amount plus sharing of a portion of any future profit they make on the house sale.

Reduce loan balance to a level where you will have 5% positive equity in the house. That is, rather than the original amount that has you drowning, (set your debt at 5% below the appraised value of the house.)

Modify the mortgage so monthly payments reflect the reduced underlying principal balance. Then, in annual increments over the next three years, the lender will write off the amounts of the original debt balance that we reduced. In exchange, they will expect that homeowners do two things: Stay current on your loan payments, and agree to let lender share 25% of any future gain you make on the house at resale.

Results of this program so far:

The results to date: 79% of the customers offered the program in the test signed up, and the re-default rate has been just 2.6% — far below the 40% to 50% rates within similar time periods seen in some federally sponsored loan modification efforts. Ocwen, which services 460,000 loans and is acquiring a portfolio of 250,000 more next month from Goldman Sachs' Litton Loan Servicing unit, said the test was so promising that it's now taking the program national. Ocwen Chief Executive Ron Faris says the key to the program is that the shared appreciation approach allows for a restoration of equity for borrowers, which is "psychologically important" and greatly affects their motivation to keep current on the modified payment terms. It gives them a stake again and gives them some hope.

Financial Planners can enhance the Principal Reduction Program:

I would add the following provisions to the Ocwen Financial program to motivate and entice Lenders to participate.

Any lender that promotes a similar program would assign a Financial Planner that would work with the homeowner and analyze their unique financial situation.

The Financial Planner works for the lender and is paid from a small portion from what the Homeowner saves in their newly reduced mortgage payment.

The Financial Planners function is to come up with a workable financial plan for the homeowner to follow based on their monthly income and expenses and create a blue print for the Homeowner to follow. This means educating and implementing a retirement savings program, rainy day fund, college fund and vacation fund. The financial planner can also suggest investment products offered by the current Lender. This means the Lender recoups’ some of the lost Principal Reduction funds in the form of IRA‘s, 401 K’s., Money Market Accounts and other investments. They then can use these investment premiums to reinvest in their company to increase their profits which in turn will help stabilize the Housing and Financial Markets.

The Financial Planner also makes sure a plan is put into place to pay off credit cards and possibly have their employer the (Lender/bank) consolidate the credit cards and facilitate the means to pay them off

The Financial Planner is also keeping the interest of the Lender in mind, almost guaranteeing that the Homeowner does not default on the mortgage.

The whole point here is the Financial Planner is helping the Homeowner develop a plan to stay on tract, pay their mortgage, pay off credit card bills, save for retirement and free up disposable income. This means the homeowner will now have disposable income to buy goods and services that will stimulate the economy. This means job creation and new home purchases. Part of the new jobs created would be thousands of financial planners hired across the country by the Lenders offering the Principal Reduction program. With 11 million Home Mortgages underwater, that’s a lot of Financial Planners that need to be hired. Think what that would do to the National unemployment statistics. Most importantly, Financial Planners would get millions of back on the road to good ‘responsible’ financial shape. The Homeowner wins, the Lender/Bank wins and the Economy wins.

I like the above program because both the lender and the homeowner work together to solve the Underwater Mortgage Crisis. The Homeowners stays current on their mortgage, follows a financial “blue print” developed by the “Lenders” financial planner. Also, based on financial planner’s recommendations, Homeowner pays off their credit cards, creates an investment portfolio and now has disposable income to spend on goods and services. The lender receives a return on their investment by receiving 25 % of profit from the sale of the home, a revenue return in the form of Homeowner purchasing their investment products and the end to the stampede of Home foreclosures.

Now all we need is the courage and vision to implement this program.

Thank you,

Mark

Barnegat NJ

Jonathan Benya

September 5, 2011 at 1:44 pm

Who do we want to protect? The banks stuck in a quagmire or the owners getting foreclosed on illegally? Nothing can recover until we get through the foreclosure process, right?

It's interesting to note that the banks have been bailed out once, and homeowners weren't. Now we're trying to protect the homeowners and it's continuing to strangle the market. Unfortunately the choice doesn't matter. Regardless of which side you choose the answer is going to be wrong.